- Friday, March 4th, 2022

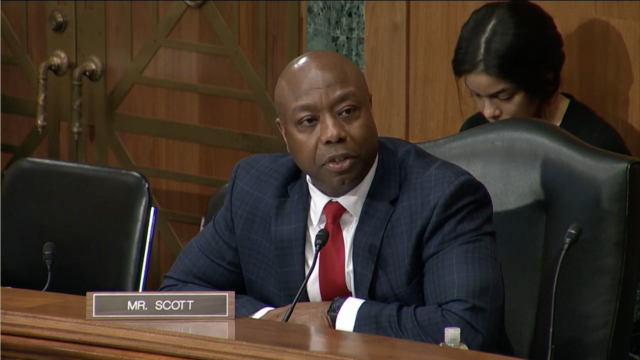

Scott Points to Inflation Challenges and Fed’s Response at Banking Hearing

WASHINGTON – Today, Senator Tim Scott (R-S.C.) questioned Fed Chairman Jerome Powell on the tools and strategies available to the Fed to lower inflation rates and increase spending power for Americans. Sen. Scott also highlighted the impact that inflation is having on everyday Americans who are facing rising prices with little reprieve.

Click to watch Sen. Scott’s Questions

Read a full transcript of the exchange below:

SEN. SCOTT: Thank you, Mr. Chairman. Thank you, Chair Powell, for investing the time with us. We have seen you a lot lately, and I think it’s important that we continue to have the conversation in public about the priorities of the Fed. One of the concerns that I have [and] I think both Senator Toomey and Senator Crapo have discussed [is] the importance of the Fed staying on mission and not looking for ways to expand the mission.

Looking at nominees like Ms. Raskin’s approach in public statements as [it] relates to the environmental responsibilities that the Fed should take on, I am completely, unequivocally, opposed to that direction. I know that there’s a lot of attention being paid these days to ESG. I think that is a bad direction for the Fed. The Fed should focus its attention on its primary responsibilities and frankly, not even get involved in congressional matters.

I know that Senator Tester had some important questions to the wrong person about truckers. I think if we we’re going to have a long, serious debate about your opinion on what Congress should do to help truckers, we would start back in the Obama administration and look at the hours of service that curtailed the number of available truckers that we have and the amount of time that they could spend on the roads.

So there’s a lot of things that the Fed shouldn’t do. The one thing that we want you to continue to do is focus on the impact that our everyday folks, like in Abbeville, South Carolina and Anderson, South Carolina, are feeling: the pressure from the inflationary effects of this economy. And we can’t tie that to Russia or conflict. We can just tie that to bad decisions by Democrats. And the Biden administration would on day one, you cut off the Keystone XL pipeline, which could have pumped 800,000 barrels a day. And we are dependent on Russian oil at 600,000 barrels a day.

The inflationary impact that South Carolinians have felt since December 2020 where prices were at $1.99 and now, they’re $3.40, [makes me] think about the seniors who are trapped in too much month and too little money. And I think to myself that too many folks on fixed incomes throughout this country and specifically in South Carolina are having to make decisions about rationing— rationing medicine, rationing food, and rationing energy, whether in your car or at your home.

This is a crisis. I love to hear that our wages are up four or five [percent] but inflation is up seven and a half percent. So the net effect is that the invisible tax that we refer to here in Washington as inflation is eroding, degrading the spending power of everyday Americans, and they are not gullible. They know exactly what has changed. And any time you put fuel on a fire, you should expect it to get hotter. And our economy reflects that same direction. And those are concerns that I have.

I know that yesterday you spoke at length about how the Fed policymakers are working to game out a variety of policy scenarios to grapple with the uncertain economic risks posed by the ongoing geopolitical turmoil while simultaneously working to curb still rising prices.

I think that is an important and incredible balance that you will be in charge of. And I frankly didn’t vote for you the first time, I’m voting for you this time, because I think that you’ve proven that you have kept your eye on the ball and that it’s necessary for folks in my state and around this country.

I would love for you to spend my 90 seconds left — [talking] to me about the gaming out of scenarios that the Fed is going through so that the average person in our country can appreciate the depth of knowledge and the time that you’re investing in helping us understand the scenarios that could happen.

CHAIRMAN POWELL: Sure, so we have tools to bring inflation down and they work by raising interest rates. We do that over time. What that does is it increases mortgage rates, but just at the margin, and the same thing with car loans and things like that. And ultimately that slows down demand ideally in a way that comes to a gradual halt and economic activity continues.

So that that’s what we’re trying to do here. Right now, we need to move away from very low interest rates. They’re not appropriate for the current situation in the economy. The economy is very strong. Unemployment is low. Wages are going up. The labor market is quite healthy. And inflation is all too high. So we’re responsible. We’re accountable for inflation, and we’re going to use our tools to bring it down.

SEN. SCOTT: May I have a little more time? Chairman, I know this is your committee. Thank you, sir. Very kind.

So the question for you, as you think about the next meeting, when you discuss the interest rate increases, are there increments that you would consider not foreshadowing in your decision, but the incremental increases that you think would bring the spending and the inflation down while not over challenging the economy?

CHAIRMAN POWELL: Yes. As I mentioned yesterday, my thinking at this time, which is a very, very sensitive time in markets and in the world because of what we’re seeing happening in Ukraine, and we don’t know the economic implications of that. I said that I would be recommending and supporting a one quarter of one percent interest rate increase at our March meeting, which is two weeks from yesterday.

But I also said that if we don’t see inflation behaving as we expect it to be, which is to peak and begin to come down, if we see inflation behaving in ways not consistent with that, then we’re prepared to raise by more than that amount, you know, in a meeting or meetings.

SEN. SCOTT: Very good. I would simply say for, as I call them, the kitchen table economists all across the country – typically moms making hard decisions on rationing the amount of resources that they have and the priorities that they have – I think it’s really important for us to make as clear as possible, as simple as possible, their understanding and appreciation for what’s happening. When you’re trying to run a very strong and heavy load at home and you have a full-time job, think what we can do to talk in a way that makes it easy for us to digest at home. We are doing our public, the average person in our country, a lot of good to understand what we’re trying to explain. Thank you.

###