- Tuesday, March 28th, 2023

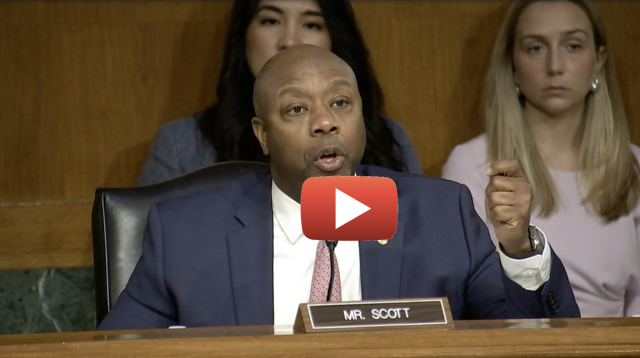

Scott Slams Regulators for Supervisory Failures

WASHINGTON – In his opening statement at today’s U.S. Senate Committee on Banking, Housing, and Urban Affairs hearing, Ranking Member Tim Scott (R-S.C.) emphasized that the recent failures of Silicon Valley and Signature Banks were the result of bank mismanagement, supervisory neglect, and the Biden administration’s inflation crisis, which caused the need for rapid interest rate hikes.

Focusing specifically on supervisory neglect, Ranking Member Scott cited reports that outlined the extent to which the risks at Silicon Valley Bank were known to regulators before its collapse and demanded to know why regulators failed to take appropriate supervisory action to address them. The Ranking Member’s remarks also laid the groundwork for ongoing congressional oversight of the bank failures.

Click here to watch the opening remarks.

Ranking Member Scott’s opening remarks as delivered:

Today, we are here to understand just how we found ourselves in the middle of the second and third-largest bank failures in United States history. Though our questions are nowhere near answered, this is an important first step in providing transparency and accountability necessary to the American taxpayer.

I’d like to thank [you], Mr. Chairman, for taking the time and working with me to try to bring the bank CEOs into this hearing. I think it’s incredibly important that we hear from the folks specifically and uniquely responsible for the failure of these banks, the folks who managed them.

By all accounts, this is a classic tale of negligence, and it started with the banks themselves. Without any question, that’s where the buck stops. So, it is imperative that we hear straight from the horse’s mouth, so to speak, to find out why these banks were so poorly managed and so poorly managed [their] risks.

Unfortunately, the bank executives aren’t the only managers we’re missing.

The Secretary of the Treasury and the Chairman of the Federal Reserve are also not here to testify. I don’t mean to offend the witnesses that are here, but it is hard to believe the Biden administration seriously is concerned about the failure that we’re seeing when they themselves are shielding the top official at the Department of Treasury.

The same official [who] briefed the President and invoked the System Risk Exception.

Nor do we have Chair Powell here, instead, we have the Vice Chair of Supervision here to use our Committee as a platform to talk about the wrongs under his supervision. As the Federal Reserve has already announced, he is conducting a review to assess any supervisory failures, which is an obvious, inherent conflict of interest and a classic case of the fox guarding the hen house.

The Fed should focus on its mission and not the climate arena. This is a waste of time, attention, and manpower. All things that could have gone into bank supervision.

Banks, like any other business, must manage their risk and be good stewards for their customers. But unlike other businesses, banks are highly regulated. Sometimes – banks even have their regulators sitting in their banks and continually monitoring their risks and activities – as is the case with Silicon Valley Bank.

For the last two and a half weeks, the regulators have consistently described Silicon Valley as unique and highly “idiosyncratic”—meaning the warning signs should have been flashing red and SVB should have stood out as what it was — absolutely a problem child. Clear as a bill were the warning signs.

In fact, reports indicate that these warning signs were already flashing, and on March 19, the New York Times wrote that “Silicon Valley Bank’s risky practices were on the Federal Reserve’s radar for more than a year….”

Moreover, Silicon Valley suffered from extreme interest rate risk, due to investments in long-term securities that declined in value because of soaring inflation. Of all our supervisors, the Federal Reserve should have been keenly aware of the impact its interest rate hikes would have on the value of these securities, and it should have been actively working to ensure the banks it supervises were hedging their bets and covering their risk accordingly.

But now we know, based [on] your testimony Mr. Barr, that the Fed was aware! In fact, in 2021 your supervisors found deficiencies in the bank’s liquidity and its management, resulting in six supervisory findings. Later, in 2022, supervisors then issued three findings related to ineffective board oversight, risk management weaknesses, and the bank’s internal audit function. What were the supervisors thinking?

The law and the regulations are crystal clear; the Federal Reserve can take any supervisory or enforcement action it deems necessary to address unsafe and unsound practices.

Recent reports confirm what we already know, your priorities and your work with the San Francisco Federal Reserve Bank President, Mary Daly, centered on climate change—an issue wholly unrelated to the Federal Reserve’s dual mandate and role as supervisor. Given SVB’s social and climate agenda, one must ask if SVB’s investments in climate caused [its] regulators to be a bit more permissive of its risks.

If you can’t stay on mission and enforce the laws as they already are on the books, how can you ask Congress for more authority with a straight face?

To that end, I hope to learn how the Federal Reserve could know about such risky practices for more than a year, and fail to take definitive, corrective action. By all accounts, our regulators appear to have been asleep at the wheel.

In addition, I also hope to learn more from the FDIC about [its] role in the receivership and sale of both SVB and Signature Bank. Especially on the auction and bid process.

I am very concerned that private sector offers appear to have been submitted, and yet, were denied. If Silicon Valley Bank had been purchased before it failed, the panic and the shock to the market and to market confidence we’ve seen over the past two and a half weeks may have been avoided.

If Silicon Valley had been purchased over the weekend of March 10, confidence in the marketplace may have sustained Signature Bank and prevented its failure.

The FDIC’s bid auction process has been a black hole for Congress and the American people—and we deserve answers.

I know hindsight is 2020—but when you hear rumors that this process was delayed because the White House doesn’t like mergers in any shape, form, or fashion, it makes you wonder what actually is going on. Sometimes, when it looks like a duck, quacks like a duck, it’s just a duck.

As I close on this opening statement, three things remain clear to me regarding SVB. First, the bank was rife with mismanagement. Second, there was a clear supervisory failure. Our regulators were simply asleep at the wheel. And finally, President Biden’s reckless spending caused [this] 40-year high in inflation, and the country, as well as the bank, experienced tremendous loss.